Bears have taken control of BTC prices by forcing 111 daily closes below $25,000, a trend that is unlikely to reverse, derivatives data shows.

It has been 111 days since Bitcoin (BTC) closed above $25,000, leading some investors to be less sure if the asset has established a bottom. Currently, global financial markets remain jittery amid heightened tensions in Ukraine following the Nord Stream incident this week.

The Bank of England's emergency intervention in government bond markets on September 28 also revealed the current level of vulnerability for fund managers and financial institutions. The move marks a sharp departure from earlier intentions to tighten the economy as inflationary pressures build.

Currently, the S&P 500 is down for the third straight quarter, the first since 2009. Separately, analysts at Bank of America downgraded Apple to Neutral after the tech giant decided to halt iPhone production due to "weak consumer demand." Finally, according to Fortune, the housing market is showing its first signs of a reversal after home prices fell in 77% of U.S. metro areas.

Let's take a look at Bitcoin derivatives data to see if the deteriorating global economy is affecting crypto investors.

Pro traders are not thrilled with a move to $20,000

Retailers typically avoid quarterly futures due to price differences from the spot market, but they are the preferred tool for professional traders because they avoid the volatility in funding rates that often occurs with perpetual futures contracts.

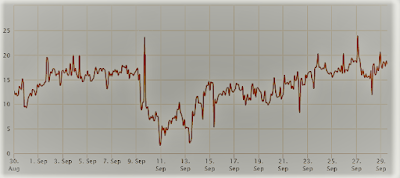

As shown in the chart above, the annualized premium for three-month futures should trade at +4% to +8% in a healthy market to cover the cost and risk involved. The chart above shows that derivatives traders have remained neutral to bearish over the past 30 days, while Bitcoin futures premiums have remained below 2% throughout.

What's more, the metric failed to improve after BTC surged 21% between Sept. 7 and 13, similar to the failed $20,000 resistance test on Sept. 27. The data basically reflects the reluctance of professional traders to add leveraged long positions (long positions).

One must also analyze the Bitcoin options market to rule out externalities specific to futures instruments. For example, a delta skew of 25% clearly shows that market makers and arbitrage departments are overcharging for up or down protection.

In a bear market, options investors gave higher price selling opportunities, causing the skew indicator to rise above 12%. A bullish market, on the other hand, tends to push the skew indicator below minus 12%, meaning bearish puts are discounted.

The 30-day delta skew has been above the 12% line since Sept. 21, suggesting options traders are less inclined to offer downside protection. In contrast, between Sept. 10 and Sept. 13, relative risks were balanced according to call (buy) and put (sell) options, indicating neutral sentiment.

A small amount of futures liquidation confirms the lack of surprises for traders

Futures and options metrics show that a fall in Bitcoin price on September 27 is more to be expected than not. This explains the low impact on liquidation. Despite a 9.2% correction from $20. 300 to $18. 500, only $22 million forcibly liquidated futures contracts. The fall in uniform prices on September 19 resulted in a total liquidation of leveraged futures of $97 million.

On the one hand, there is positive behavior because a 111-day bear market is not enough to instill bearishness in Bitcoin investors, for a derivatives metric. However, the bears still have unused firepower, given the near-zero futures premium. If traders believe in price depreciation, the indicator will reverse.